As of the end of June 2025, credit to the economy had reached more than VND 17.2 quadrillion, up 9,9% compared to the end of 2024 — a remarkable result reflecting both the strong demand for capital and the regulatory role of the banking system amid an economy still facing many fluctuations.

Alongside credit growth, the period from July 2024 to June 2025 also witnessed increasingly fierce competition in terms of image and branding. Banks not only focused on expanding financial activities but also invested heavily in digital communications, turning social media into a strategic channel to promote products, connect with customers, and foster community engagement. This has made the banking industry one of the most dynamic and noteworthy sectors in the online environment, marked by many impressive communication highlights.

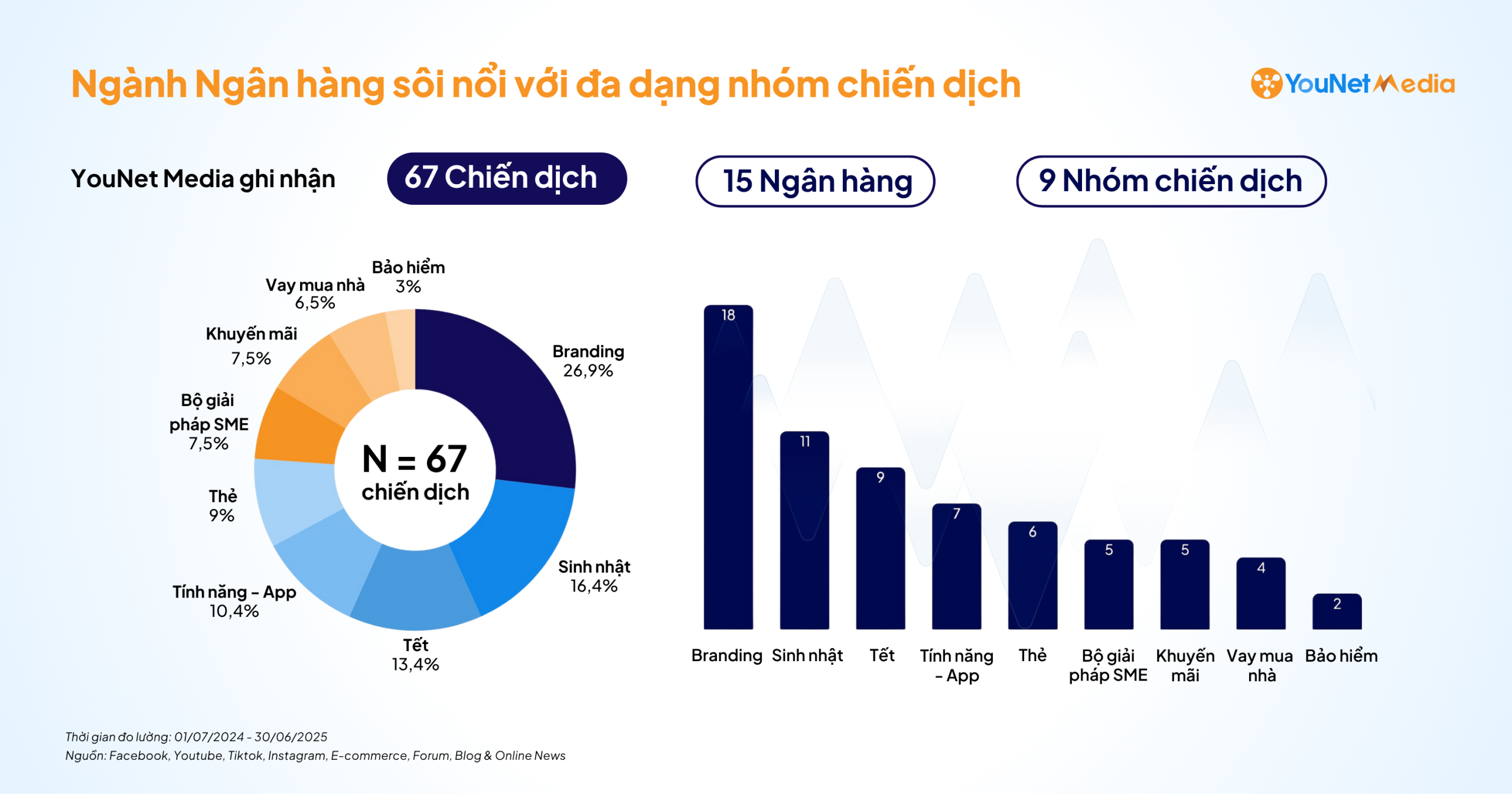

With the goal of providing a comprehensive perspective on the communication landscape of the banking industry, YouNet Media officially launches the Comprehensive Report and Analysis of Banking Communication Campaigns on Social Media 07/2024 – 06/2025, evaluating 67 communication campaigns from 15 banks. The report provides benchmark data to help marketers shape a suitable communication “formula” for the coming year — from brand building and campaign optimization to fostering trust and empathy with customers.

Download the report here.

1. Banking Communications 2024–2025: From Stability to Experience Creation

Disclaimer (*):

The definition of Banking Communications 2024–2025 within the scope of this report, as measured and analyzed, includes:

Campaigns from 15 banks: VPBank, Techcombank, ACB, MBBank, VIB, Vietcombank, MSB, HDBANK, TPBank, BIDV, OCB, VietinBank, Nam A Bank, Sacombank, and Eximbank.

Each campaign has an official name and/or a unique hashtag for identification (e.g., #SinhLoiTuDong).

Communicates an official and consistent message across all activities, clearly expressing the goals or values the campaign aims to achieve.

Implements at least two types of tactics (activities) during the campaign period.

Data is collected and aggregated by YouNet Media’s SocialHeat platform from Facebook, YouTube, TikTok, Instagram, e-commerce sites, forums, blogs, and online news platforms.

Note:

In this report, a tactic is defined as a specific activity or execution format used by the bank within the campaign framework. Examples include TVC, Podcast, Minigame, Livestream, etc.

__________

Over the past year, banking communications have gone beyond promoting traditional financial products. Banks have boldly entered cultural and community spaces — from K-Pop concerts and marathons to sports events and financial education gameshows.

Some notable highlights:

-

Branding campaigns accounted for the largest proportion (26,9% with 18 out of 67 campaigns), reflecting the trend of putting brand experience at the center.

-

Other campaign categories were diversified: Anniversary (16,4%), Tet (13,4%), Feature–App (10,4%), Card (9%), SME (,%), Promotion (7,5%), Home Loan (6,5%), and Insurance (3%).

-

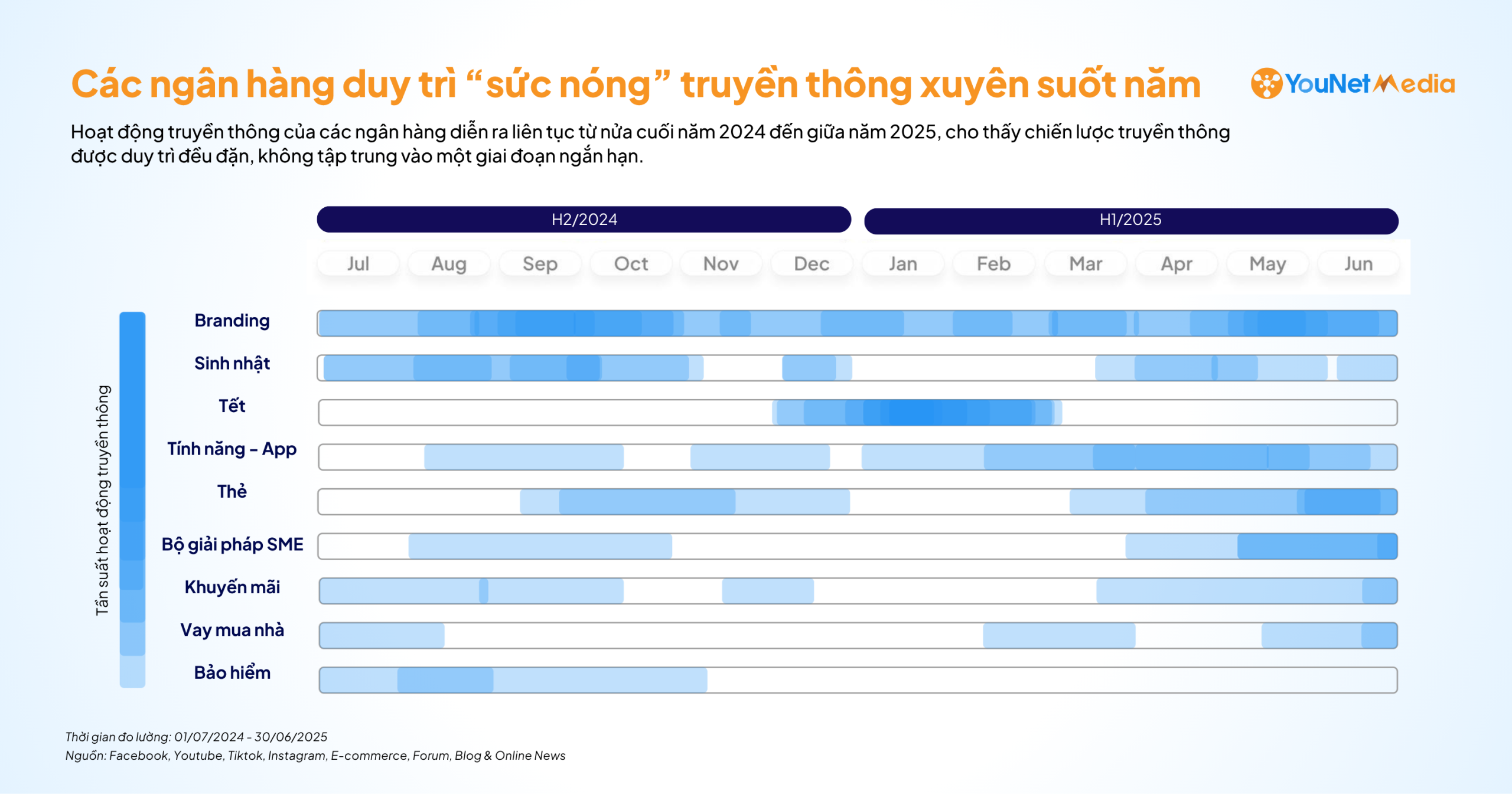

Buzz was maintained year-round, peaking during Tet and product launch periods.

-

Data from SocialHeat recorded a strong increase in total discussions related to banking communication campaigns, with hundreds of thousands of engagements across multiple platforms (Facebook, TikTok, YouTube, News, Forums, etc.).

This confirms that the banking industry has gradually shifted its focus — not only promoting products but also striving to embed itself in customers’ cultural and daily lifestyles.

2. 67 Campaigns and the Most Vibrant Campaign Groups

During the 12-month measurement period, 15 prominent banks launched a total of 67 campaigns, led by ACB (8 campaigns), followed by VPBank, VIB, Techcombank, and BIDV (6 campaigns each).

The report also highlights banks with the most outstanding communication activities of the year:

-

ACB leads with 8 diverse campaigns (ranging from home loans to branding and SME).

-

VPBank, VIB, Techcombank, and BIDV each had 6 large-scale campaigns, marked by major activities such as VPBank K-Star Spark 2025, Techcombank Marathon, BIDV Run, and VIB “Super Interest Account”.

-

Following closely are TPBank and MSB (5 campaigns), and SCB, HDBank, OCB, Nam A Bank (4 campaigns each).

These banks not only compete in quantity but are also shaping a new race: the bank that can build stronger communities and more engaging experiences will hold the advantage on social media.

3. Key Communication Trends: When Banks Expand Beyond Financial Products

Observations from the report show that the success of banks in this period stems not only from product promotion but also from how they position their brands in social life. Instead of talking about “interest rates” or “offers,” banks are choosing to enter cultural, community, and lifestyle spaces to create lasting connections.

Music & Entertainment

The most notable case study is VPBank K-Star Spark 2025 featuring G-Dragon, which attracted more than 767,113 discussions and generated 29 million interactions.

This was not merely an entertainment event but a culture branding strategy positioning the bank as part of the mainstream cultural movement. As a result, the brand becomes familiar and relatable — a “companion” for Gen Z and Millennials, who are and will continue to be the dominant segments in financial consumption.

Sports & Healthy Lifestyle

Examples include running events such as Techcombank Marathon, BIDV RUN, and HDBank Green Cần Giờ Marathon, which have become annual touchpoints attracting tens of thousands of participants.

By aligning the brand with the running movement, banks not only project a resilient, positive, and healthy image but also cultivate loyal communities bonded through shared lifestyle values.

Financial Education & Social Responsibility

Some of the most notable examples include BIDV with The Moneyverse and OCB with Pin Hunter.

The OCB Pin Hunter – Building Green Transaction Points campaign aimed to collect and safely dispose of used batteries, helping reduce electronic waste and raise public awareness about environmental protection.

After the success of Season 1, BIDV continued its collaboration with VTV Times to launch The Moneyverse Season 2, a professional financial education and career orientation program with a youthful and creative approach — becoming an engaging and useful playground for young audiences.

Through these efforts, banks are transforming from service providers into companions on the journey of youth development. By delivering financial messages through innovative TV program formats, they make finance more relatable, less rigid, and skillfully build trust in the brand.

Products Addressing “Pain Points” in Niche Markets

-

Interest-bearing accounts: Target the need for optimizing personal cash flow amid inflation.

-

SME packages: Help small and medium enterprises reduce operational burdens.

-

Home loans for under-35s: Understand the concerns, needs, and aspirations for home ownership among the urban young generation.

These products go beyond “meeting needs” — they touch real-life concerns of modern youth, positioning the brand as a practical solution to specific social issues.

Overall, it can be seen that banks are shifting from “talking about money” to “talking about life values.”

This trend helps banking brands get closer to customers, becoming part of their culture, community, and lifestyle — thereby nurturing trust, loyalty, and long-term differentiation.

This article serves only as the introduction to the comprehensive picture analyzed in YouNet Media’s Banking Industry Report 2024–2025.

To explore all 67 campaigns, 15 banks, 9 campaign categories, and in-depth social listening insights, marketers can download the full report for free here!