Fried chicken is not only a familiar fast-food dish but also a topic that sparks hundreds of thousands of lively conversations on social media. Beyond the competition in revenue and market share, the real question is: have brands truly reached the community’s voice and turned dining experiences into stories that are discussed and spread?

Let’s join YouNet Media to see which fried chicken brand is truly igniting community voices and generating real interest from qualified users through the following article!

1. Fried Chicken Industry Q1/2025: More Than 50% of Discussions Come From Qualified Users

Vietnam’s fast-food market is growing strongly, with fried chicken emerging as the central segment. According to Euromonitor’s 2024 report on the Vietnam fast-food chain market, Jollibee leads with 22% revenue share, surpassing Lotteria (21.5%) and KFC (13.4%). Besides these “slices” of business performance, another aspect that is receiving increasing attention is how brands are discussed and present in users’ daily lives.

To measure genuine resonance, YouNet Group introduced the indices Qualified Users (QU) and Content From Qualified Users (CFQU). CFQU helps filter out noise and reflects only organic discussions from real users. Thanks to that, this data becomes an important source of insights, helping brands better understand what customers truly care about regarding the brand.

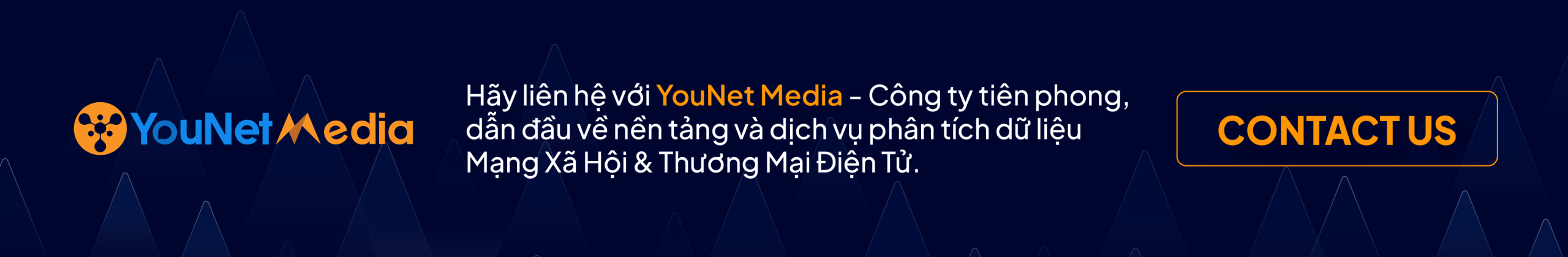

In Q1/2025, the fried chicken industry recorded 230,455 social media discussions from 128,004 users. After applying the CFQU index, only 131,936 discussions were considered authentic, equivalent to a ROCFQU ratio of 57.25%. This shows that more than half of discussions come from qualified users, who demonstrate clear interest in the brand, product, and experience.

With the Rate of Qualified Users (ROQU) reaching 78.39% (100,346 users), and with discussions often revolving around practical dining needs (eating full, tasty, convenient), the joy of the experience (gathering with friends, sharing food photos), as well as long-term loyalty to favorite brands, it shows that user interest is not only wide but also deep. This contributes to creating brand resonance rather than just surface-level buzz.

When compared to other industries, the ROCFQU rate of the fried chicken industry (57.25%) is significantly higher than that of the banking industry (ROCFQU – 37.3%) or the hybrid car industry (ROCFQU – 24.44%). Although belonging to the FMCG group, the fried chicken industry still maintains sustainable attention along with a high level of quality discussions. At the same time, it shows signs of a shift: from being seen as a convenient dish, fried chicken is gradually becoming a more considered choice, as user discussions increasingly tie to brand experiences and long-term consumption habits.

Thus, the question is not only which brand is leading in market share, but also which brand can take advantage of the resonance from quality discussions to create long-term sustainable value.

2. Which Fried Chicken Brand Leads in Qualified User Discussions?

Disclaimer (*): The analysis in this article is based on data collected from 08 fried chicken brands.

2.1 Who Truly Owns the “Community Voice” Through QU & ROQU?

After applying the CFQU index, analysis shows little difference between Share of CFQU (Share of Content From Qualified Users) and Share of QU (Share of Qualified Users). In this, Jollibee and KFC stand out absolutely, accounting for more than 70% of discussion share and more than 80% of qualified user share.

Not only do these two brands have a superior number of qualified users, but they also succeed in activating them to participate in discussions, showing the effectiveness of community content campaigns. This clearly reflects the nature of transforming brand presence into experiences, encouraging user-generated content (UGC) to grow naturally.

Meanwhile, Lotteria, despite holding the second position in Vietnam’s fast-food market share (Euromonitor, 2024), with 7.1% QU & 8.9% CFQU, still has not generated many discussions or user interactions on social media compared to Jollibee & KFC.

For fried chicken brands with relatively small CFQU and QU shares such as Texas Chicken, Popeyes, Bonchon, or Don Chicken, the amount of qualified user discussion remains limited; most content is generated primarily from the brands’ official channels. This shows that these brands still rely heavily on their own voice, while the community’s voice has not truly formed, and UGC along with natural spread effects have not been clearly activated like the other “big” fried chicken brands.

2.2 Qualified Users in the Fried Chicken Industry: Who Leads in Scale, Who Excels in Engagement?

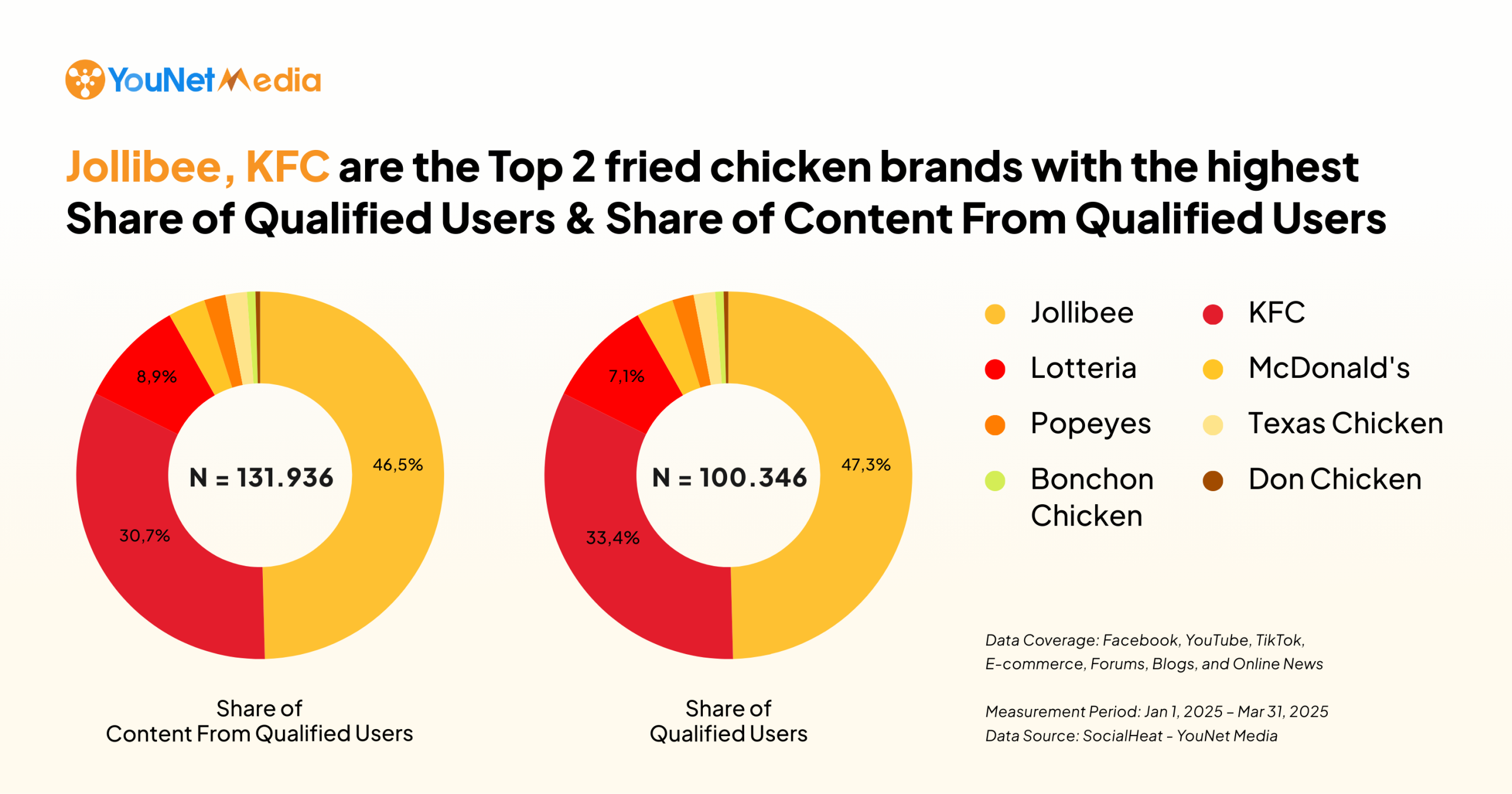

The chart on Qualified Users (QU) in the fried chicken industry reveals not only “who has more users,” but also the actual level of engagement between the brand and the community.

Two median lines: QU share (4.69%) and ROQU (78.55%), help classify brands into 04 clear quadrants.

-

Jollibee holds more than 47% QU share and reaches ROQU 79.21%, belonging to the comprehensive leading group with both large discussion scale and high qualified user levels. Notably, Jollibee succeeds in building a familiar and close-knit image, emphasizing family experiences, childhood, and street food culture. This approach allows the brand to maintain emotional connections with customers, thereby encouraging them to participate more in organic discussions.

-

KFC holds 33.4% QU share, meaning a very large user base. The ROQU index reaches 77.92%, approximately the median, showing that many of KFC’s customers may come from advantages of coverage and convenience. In terms of communication, KFC has generated remarkable buzz on its fanpage with entertaining content streams like “Joke of The Day” or “This Chicken is Crazy Good”, strongly contributing to the total discussion volume. However, data also suggests that the deep engagement of qualified users still has room to be further exploited to improve the quality of connections.

-

Lotteria, Popeyes, and Texas Chicken show a different picture: modest market shares under 10%, but all with ROQU exceeding 80%. This means they have formed loyal fan communities, often attached due to differences in flavor. For example, Popeyes stands out with Cajun seasoning marinated for 12 hours; Texas Chicken with its distinctive American-style flavor. However, their challenge lies in how to expand reach without losing the “uniqueness” that retains loyal users.

-

McDonald’s, Bonchon, and Don Chicken fall into the challenging group: both share and qualified user rates are not high. In Vietnam, McDonald’s is more famous for burgers than fried chicken, while the fried chicken segment is strongly shaped by other brands. This explains why, despite strong brand reputation, McDonald’s has not generated many quality discussions in this market.

Overall, Jollibee and KFC currently dominate both in the number of qualified users and in the volume of discussions generated by this group. Other brands such as Lotteria, McDonald’s, or smaller ones still maintain presence but have not created a proportional balance between actual market share and social media discussion power. This raises the requirement for each brand to not only leverage their existing customer base but also find ways to stimulate organic discussions to expand influence.

3. Which Platforms & Content Can Nurture Quality Community Dialogue in the Fried Chicken Industry?

3.1 Distinct Roles of Platforms & Sources of Discussion in Attracting Qualified Users

Major platforms still play central roles. Facebook and TikTok lead in interest with over 99K qualified users.

When broken down by qualified users:

-

TikTok recorded 43,937 qualified users, with ROQU 74.02%.

-

Facebook was more prominent with 55,787 qualified users, accounting for 82.37% ROQU.

-

YouTube, though with only 611 users joining discussions, achieved an almost absolute ROQU (97.29%) – making it a strong advantage in influencing purchase decisions.

Behind numbers that appear to only reflect brand presence are very different user behaviors. Facebook shows a clear advantage as a large-scale “community,” where coverage and the ability to spark discussions can quickly expand.

TikTok, in contrast, positions itself as an “emotional playground,” characterized by visuals, brevity, and easy-to-watch content—suited to create instant attention and viral effects. Meanwhile, YouTube plays the role of “trust destination”: users come here to hear reviews, watch detailed experiences, and from there form decisions to connect with the brand. This mechanism reflects tiered needs in the consumer journey: broad reach, emotional spark, then validation and trust.

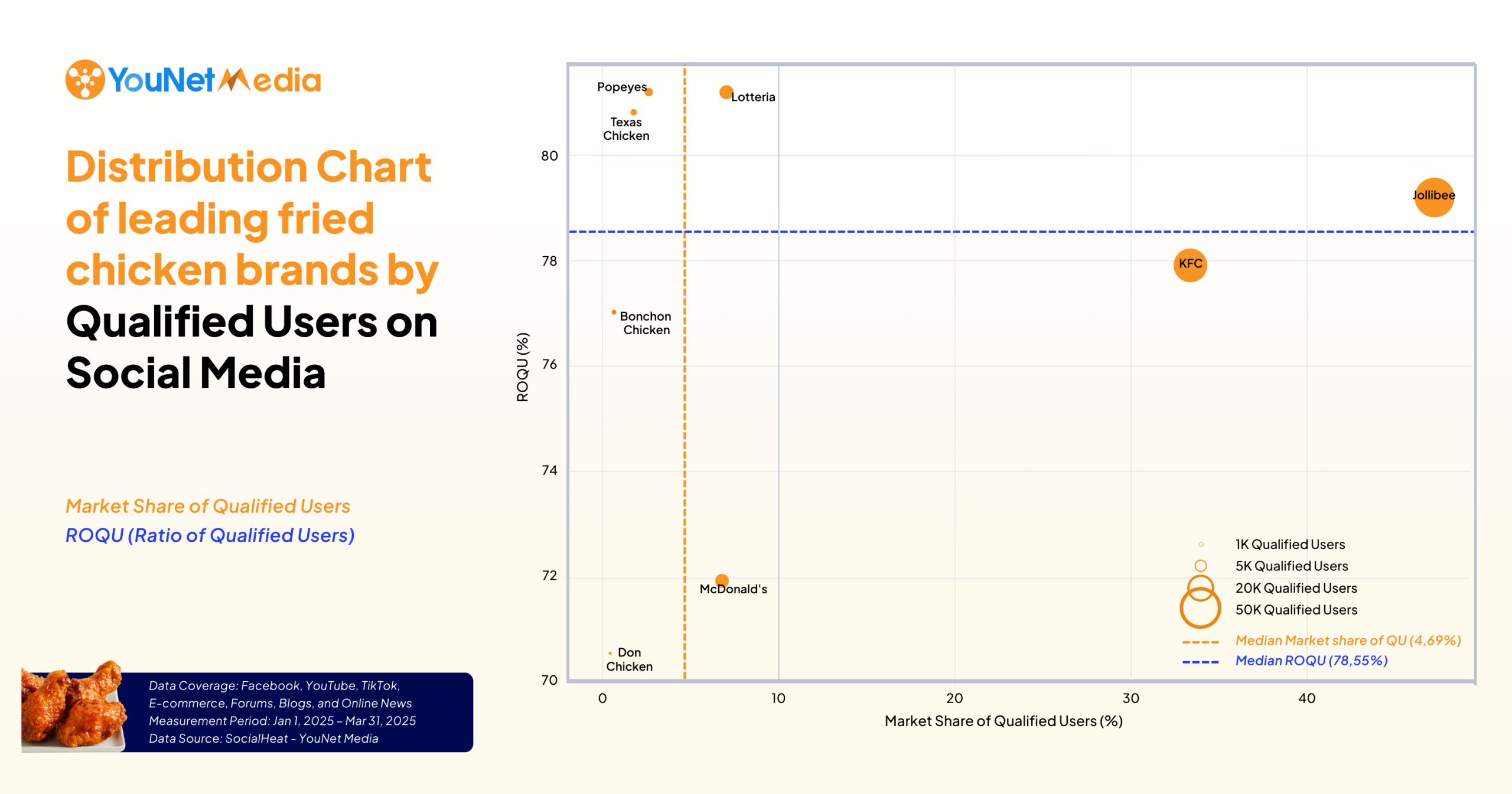

Analysis of discussion sources shows that official brand fanpages are not only for content distribution but also serve as connection points driving in-depth discussions. Specifically, in the Top 10 discussion sources generating the most qualified users in the fried chicken industry, fanpages of the 4 big brands KFC, McDonald’s, Jollibee, and Lotteria all appear. Notably, KFC’s official page leads with more than 16,974 quality discussions, far ahead of McDonald’s (3,586), Jollibee (3,330), and Lotteria (2,143).

The discussion picture is not limited to brand fanpages; for example, Tí Hin (5,788), Người Lạ Ơi (3,631), or Đài Tiếng Nói GenZ (2,017) also made it to the Top 10, with Tí Hin even ranking second. This shows that, alongside official fanpages, brands can also leverage community, entertainment, lifestyle pages, or KOLs/Food Reviewers to expand reach and increase interaction with the qualified user group.

This also suggests that brands should explore using community fanpages and influencers to expand reach and connect more deeply with qualified users.

Within brand fanpages, the difference between McDonald’s and Jollibee shows that discussion volume does not necessarily equate to engagement. McDonald’s generates more discussions, but the proportion of qualified users is only 6.8%.

While official channels help brands maintain direction and control messaging, organic communities bring emotional spread and authentic experiences. Brands can fully build balanced strategies between brand communication on official pages, closeness through trend-driven content, and bookings with communities and influencers to attract qualified users.

In this picture, KFC and Jollibee stand out as two brands with very distinct content approaches to reach qualified users. Instead of just appearing frequently, both brands turn content into creative tools, catching trends, and sparking engagement, thereby opening unique approaches that strengthen brand awareness in customers’ minds.

3.2 “Two-Horse Race” Between KFC and Jollibee: Trend-Driven Creative Content vs. Engagement Through Real Experiences

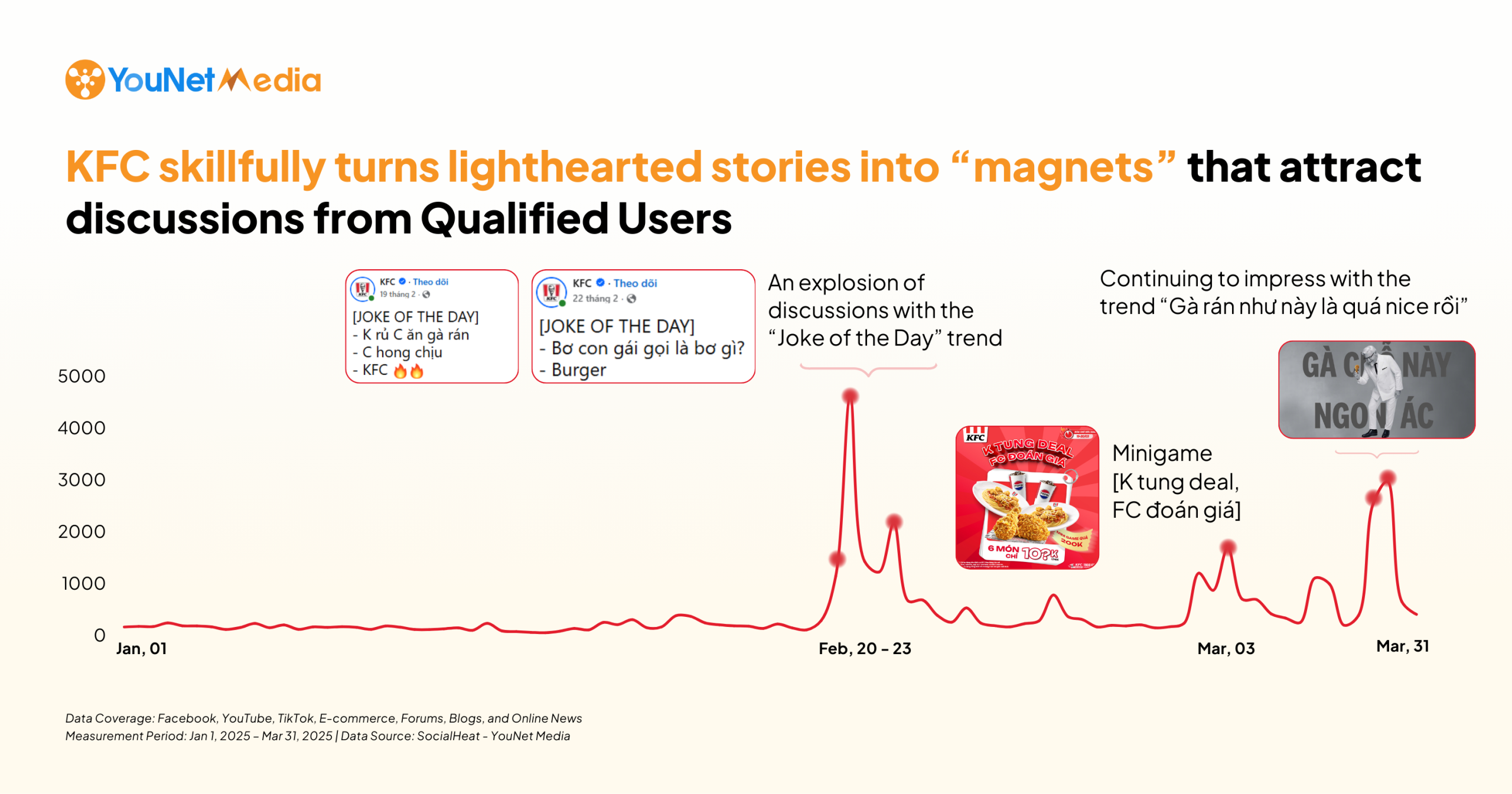

Out of more than 33K qualified users participating in discussions about KFC, 2 trend-based posts contributed over 40% of the total:

-

“Joke of the Day” (9,713 qualified users)

-

“Fried chicken like this is just too nice” (3,804 qualified users).

The success here lies in KFC not only posting funny content to make people laugh but also making viewers want to comment directly under the posts. As a result, interactions do not stop at likes or shares, but turn into real conversations about the brand. At the same time, it shows KFC has tapped into Facebook’s “mechanism”: combining entertainment (what makes users stop) and product (what makes them talk about the brand). Simply put, KFC turned fun stories on the internet into ways for customers to chat and connect more with the brand.

In contrast, Jollibee relies more on actual customer & community experiences than trend-catching to generate discussions. For example, the clip “The bee wants to join the street parade” in early January or the series of birthday party content at stores in late February were not only spread from the official fanpage but also widely re-shared by many users.

Importantly, most discussions about Jollibee come from employees and customers themselves: from mukbang videos, food reviews, to posts about promotion combos. This type of content is powerful because it comes from real experiences, making viewers feel closer and more trusting.

Although the total number of comments is fewer than KFC, Jollibee still creates strong connections with customers because people talk about what they truly experienced, not just commenting for fun on a fleeting trend.

In the fried chicken market, brands often compete both in communication coverage and in actual engagement with customers. KFC and Jollibee are typical examples of two approaches: one leveraging trends and entertainment factors to create discussion waves, the other relying on real experiences and community content to build trust.

Therefore, the effective direction lies in combination: creating trend-driven content to expand reach, alongside real experiences (products, services, store atmosphere) to retain customers long-term.

-

Trend-catching helps brands quickly attract attention and broaden reach.

-

Real experiences (service, product, store atmosphere) provide content that customers find authentic and trustworthy, thereby sustaining lasting engagement.

The important point is not simply posting a lot, but balancing breadth and depth: appearing widely enough for everyone to see, while creating real connections that make customers want to stay loyal. This also depends on choosing the right platforms (where target customers are most active) and leveraging content formats that easily turn into actions from qualified users (e.g., interactive comments, experience-sharing, or store visits).

4. Conclusion

Data from Q1/2025 shows that the fried chicken industry faces not only pressure and competition in revenue market share but also significant interest from users. With more than 50% of discussions coming from qualified users, it reflects a shift: from “convenient fast food” gradually becoming part of the modern consumer’s everyday life.

Notably, each brand takes a different approach: KFC leverages entertainment and trends to broaden reach, Jollibee taps into closeness and real experiences to build trust, while smaller brands maintain loyal communities but have yet to generate strong resonance. From this, combining viral content to expand reach with real experiences to sustain engagement can become a key direction for fried chicken brands amid increasingly fierce competition.

Thus, the winning formula lies in combining viral content (for reach) with real experiences (for loyalty)—balancing width and depth of presence, and tailoring platforms/content formats to activate quality users.

YouNet Media, supported by YouNet Group, proudly pioneers the development and application of Content From Qualified Users (CFQU) in Vietnam’s monitoring and measurement systems. CFQU accurately identifies authentic content, effectively filters out ads, repetitive posts, or non-user content, delivering the truest picture of communication effectiveness.

As a result, every data point and analysis reflects genuine user voices and organic resonance, empowering businesses to craft strategies and make decisions based on clean, reliable data.