YouNet Media and YouNet ECI partnered with Blue Ocean Partners as data analytics and strategy advisors for the launch of a new sunscreen brand. Below is how YouNet used data to map consumer pain points and define a clear communication direction for the new entrant.

When the market already has dominant players: How can a new entrant stand out?

This was the challenge Blue Ocean Partners faced when introducing a new tone-up sunscreen to Vietnam.

Blue Ocean collaborated with YouNet Media and YouNet ECI – two leaders in data analytics and strategy consulting – to uncover unmet consumer pain points that current competitors have not addressed, and to identify a market whitespace large enough for a new sunscreen brand to stand out from day one.

Blue Ocean needed to solve two core questions:

- What consumer pain points in tone-up sunscreens remain unmet by existing brands?

- How can we highlight a differentiated value proposition strong enough to change current usage habits?

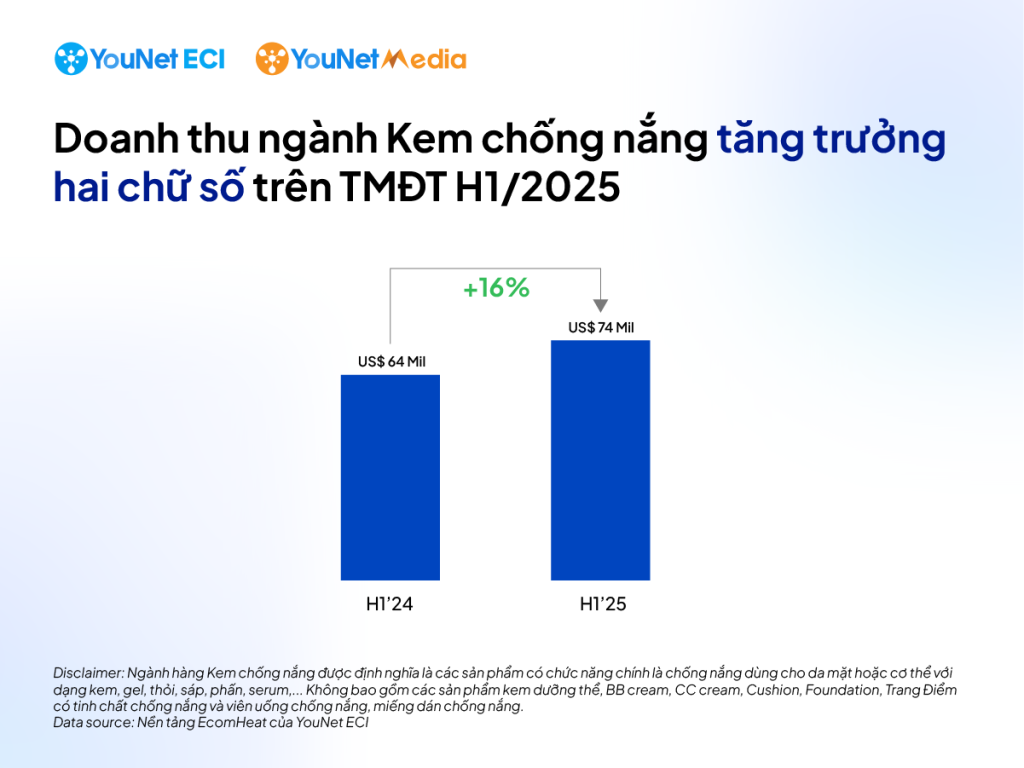

EcomHeat data from YouNet ECI shows that in H1 2025, Vietnam’s sunscreen category on e-commerce reached US$ 74 million, up 16% vs. H1 2024.

Disclaimer: For this article, “sunscreen category” includes products whose primary function is sun protection for face or body in formats such as cream, gel, stick, balm, powder, or serum. It excludes body lotions, BB/CC creams, cushions, foundations, makeup with SPF, oral supplements, and sun patches.

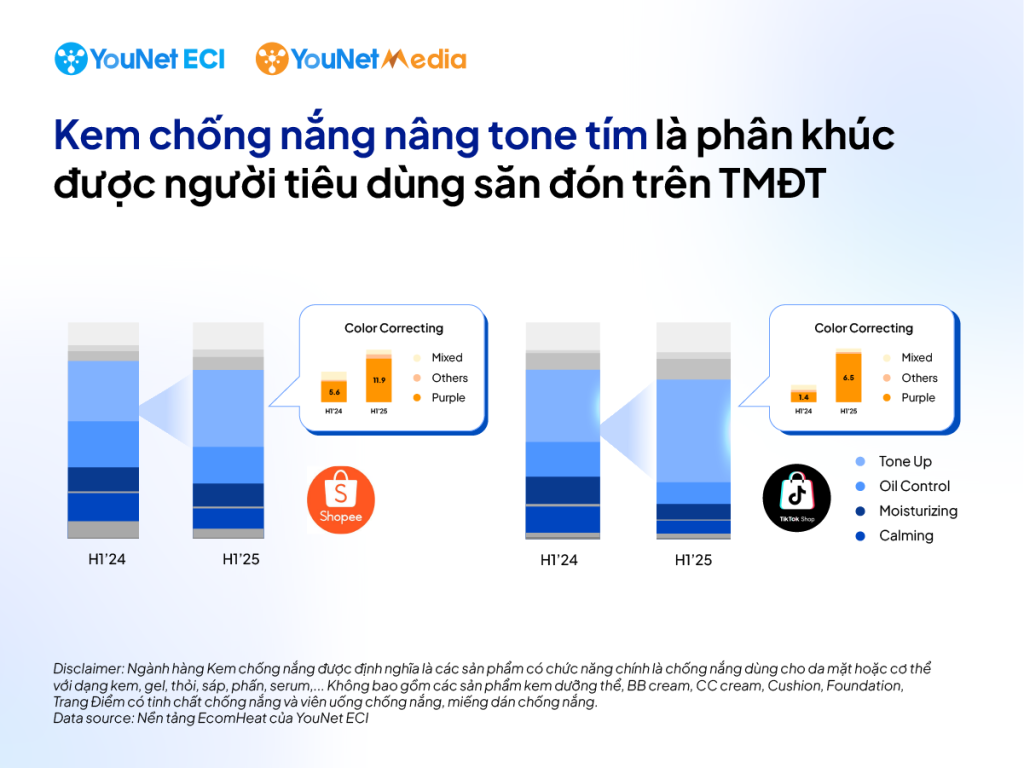

Within the category, the tone-up segment stands out for both size and momentum: +10% on Shopee and a +190% surge on TikTok Shop in H1 2025 vs. H1 2024.

Notably, in this segment, the purple tone-correcting shade – suited to neutralize yellow undertones common in Asian skin – contributed 11.9% of revenue on Shopee and 6.5% on TikTok Shop. This share is materially higher than other tone-correcting shades and has grown strongly year over year.

Tone-up sunscreens – especially purple tone-correcting – represent a promising entry lane for new brands in Vietnam, as consumer demand rises and the category retains headroom for growth.

“Staying Power”: The Under-served Pain Point

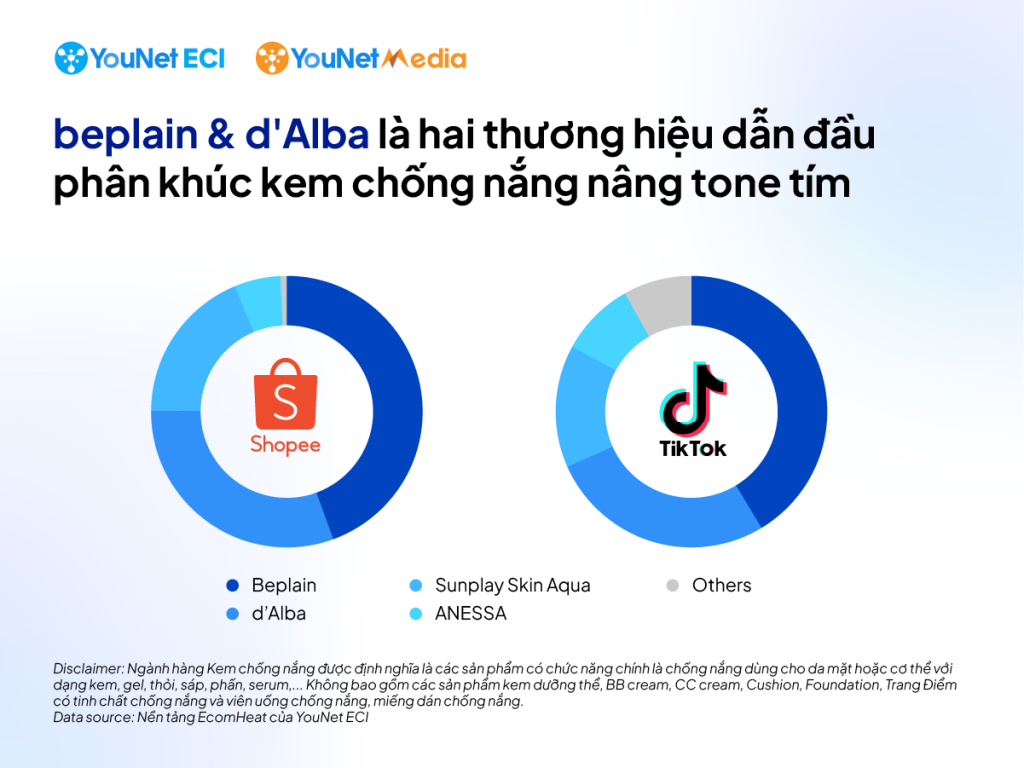

Among purple tone-up bestsellers in H1 2025, beplain and d’Alba are prominent – capturing 75%+ revenue share on Shopee and 67%+ on TikTok Shop within the purple tone-up sub-segment.

They also saw strong social interest: 21,986 mentions about beplain (sentiment score 0.81) and 15,459 about d’Alba (sentiment score 0.76) in H1 2025.

Disclaimer: Social Listening data reflects public posts and comments about purple tone-up lines of beplain and d’Alba from 01/01/2025–30/06/2025.

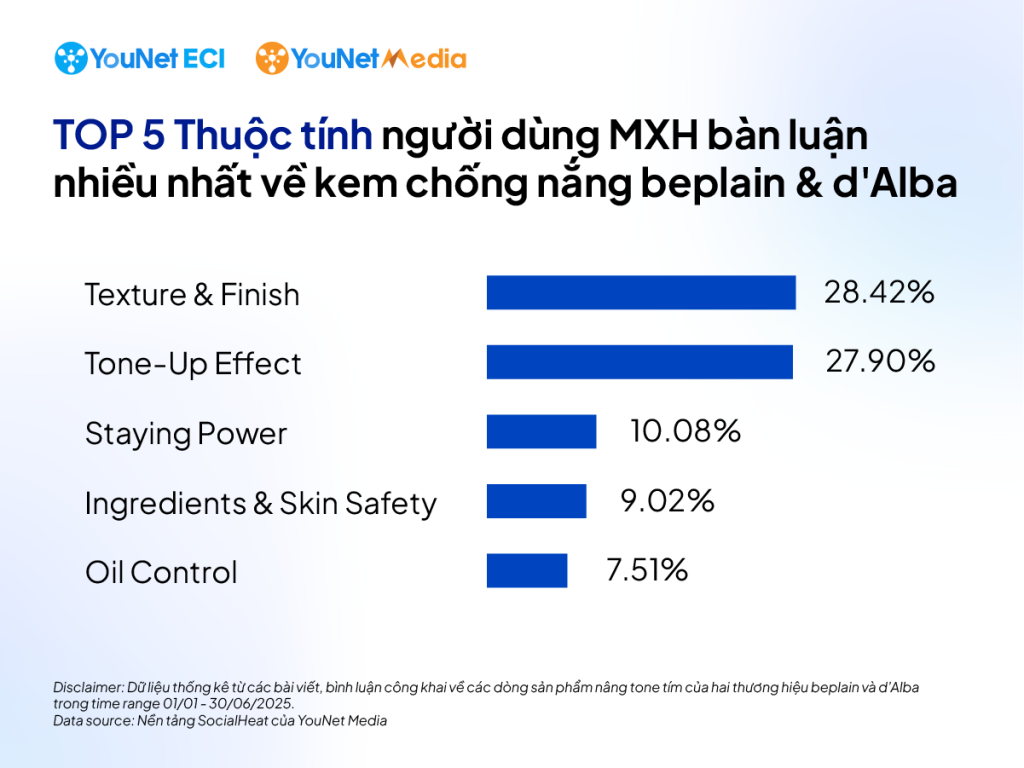

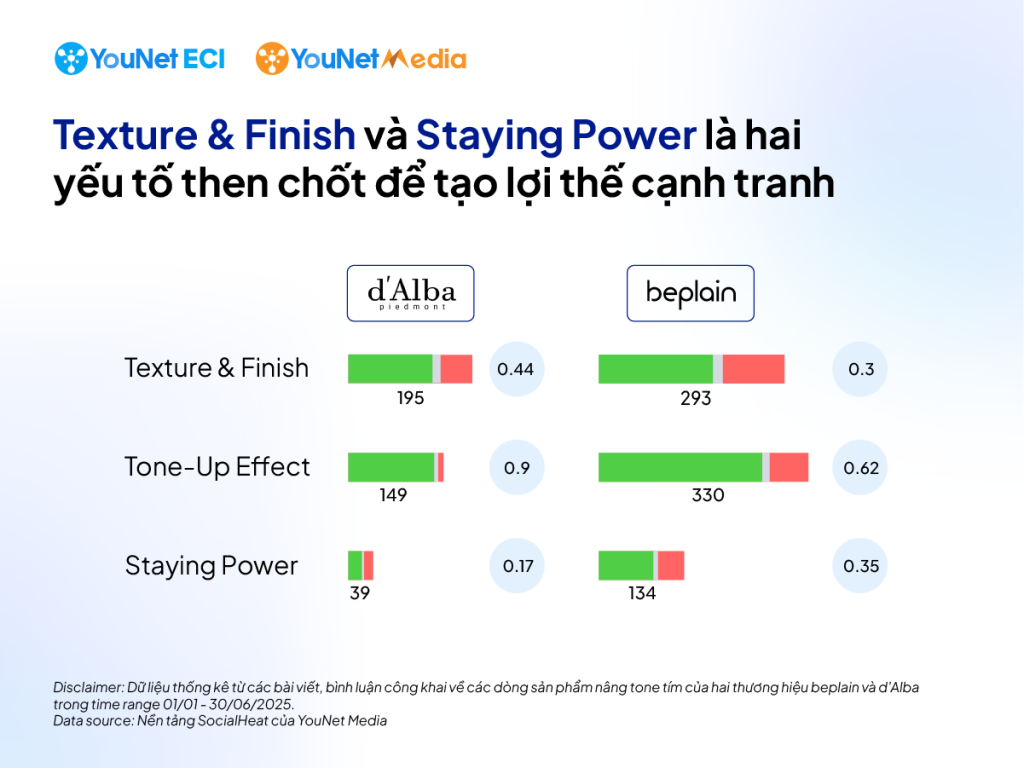

Over 56% of conversations focused on two attributes: Texture & Finish (on-skin feel and appearance after application) & Tone-up Effect (instant brightening) The third most discussed attribute was Staying Power (durability and ability to hold tone all day).

YouNet Media’s analysis shows that both brands earn high favorability for Tone-up Effect – sentiment 0.90 (beplain) and 0.62 (d’Alba). However, Texture & Finish and Staying Power do not impress users yet: both attributes carry sentiment below 0.5 for both brands.

Whitespace: Consumers like the instant tone-up, but still want: long-lasting tone retention through the end of the day, and a more pleasant on-skin experience (texture/finish).

These become the two actionable levers for Blue Ocean to build clear differentiation in communications and commerce – shaping product claims, proof points, and content that directly address what the market has not yet satisfied.

Lam Dang, Sales & Marketing Director, Blue Ocean: “We view YouNet’s analytics as a compass. It gives us a solid foundation to position the product precisely and distinctively from day one, securing a long-term competitive edge for our new sunscreen brand in a fast-moving market.”

The study offers a fresh lens for any sunscreen brand considering entry into Vietnam. YouNet Media and YouNet ECI will continue to share updates on research findings and campaign execution in upcoming articles.

About YouNet ECI: YouNet ECI, a member of YouNet Group, is a pioneer in E-commerce Growth Consultation with Data Intelligence for Brands.

Brand & Category Growth Tracking: We provide an advanced solution for market analysis, online sales performance assessment, and building effective competitive strategies on E-commerce. Learn more about the service here.

About YouNet Media: YouNet Media, a member of YouNet Group, is the leading Social & E-commerce Intelligence company in Vietnam and Southeast Asia.

Category Analytics: We provide a comprehensive view of categories and brands to support effective communication planning, including brand and competitor feedback, campaign effectiveness on social media, and category interest signals. Learn more about the service here.