Every admissions season, social media once again becomes a “meeting point” where applicants and parents search for, compare, and exchange information about private universities.

The rapid rise in discussions shows there is no small level of interest, but behind that buzz lies a more important question: how much of it comes from people who are truly considering, seriously researching, and capable of influencing the school-choice decision?

The article below will take an in-depth look at the discussion landscape surrounding Private Universities on social media, to identify which brands are attracting high-quality interest and building substantive connections with learners.

1. Lively admissions-season discussions: But only nearly 40% of discussions about Private Universities come from quality users

During the period 01/03 – 30/09/2025, discussions around private universities on social media became lively, reflecting the vibrancy of the admissions season and the increasingly proactive behavior of applicants and parents in researching, comparing, and exchanging information. The fact that schools continuously appear across many platforms shows that competition is not only about short-term enrollment quotas, but also about the ability to build a position in learners’ minds.

To see more clearly the level of genuine interest behind these discussions, let’s apply the metrics Qualified Users (QU) and Content From Qualified Users (CFQU), developed by YouNet Media and YouNet Group.

In this context, CFQU acts as a quality filter, removing interactions that are viral in nature or merely repetitive information, and retaining only organic discussions from users who demonstrate serious research and exchange behaviors. As a result, the data not only reflects which school is “mentioned the most,” but also helps identify the depth of interest and the potential for long-term influence on school-choice decisions.

The QU and CFQU metrics help separate discussion layers more clearly. With over 1.7 million social media discussions around Private Universities, the figure drops to just over 600K discussions considered substantive, corresponding to an ROCFQU rate of 35.50% after applying the CFQU metric. This shows there is still a group with genuine interest—tracking multiple aspects and joining discussions when information meets their research needs.

When compared with other industries, it becomes clear that discussion behaviors differ sharply by category. Fast-decision categories like F&B fried chicken (ROCFQU reaching 57.25%) often receive more high-quality responses thanks to users’ direct and immediate experiences. Meanwhile, categories that require more careful consideration such as Banking (ROCFQU at 37.3%) still maintain stable discussions.

For private universities, although the decision is long-term, communication activities often occur in short phases. Therefore, being mentioned a lot does not always come with deeper exchanges. This indicates learners need information that is clear, timely, and sufficiently detailed to support their consideration process.

2. Which schools lead in the number of quality users participating in discussions?

Disclaimer (*): The analysis content in this article is based on data collected from 14 private universities, as defined by the Ministry of Education & Training, located in Hanoi and Ho Chi Minh City, and having at least 5,000 discussions per month on social media during the period 01/03 – 30/09/2025.

2.1 Which private universities best activate participation and exchange among the quality-user group?

After applying the CFQU metric, the discussion picture of the private university segment reveals a notable point: the gap between Share of CFQU (share of discussions from quality users) and Share of QU (share of quality users) is not large. This reflects a relatively even alignment between the scale of quality users and the ability to activate them to participate in exchanges.

Most prominent is the TOP 5 leading universities: Van Lang University, Phenikaa University, Van Hien University, Dai Nam University, and Ho Chi Minh City University of Foreign Languages – Information Technology. This group holds over 60% of the total share in both aspects: share of discussions (64.60%) and share of quality users (63.74%). This figure indicates not only an advantage in community scale, but also the ability to convert user presence into substantive discussions.

More importantly, the TOP 5 universities not only have a large volume of quality users but also effectively activate them to participate in exchanges. This suggests that community content strategies are working, where the brand is not merely delivering one-way information but actively opening dialogue spaces among the school, learners, and parents. As a result, the brand is perceived as an open ecosystem.

In practice, each school chooses its own approach but aims toward the same goal of sustaining interaction throughout the admissions season, such as:

-

Van Lang University, Phenikaa University, and Van Hien University create impact through large-scale Job Fair and Career Fair activities, providing direct touchpoints between students, the school, and businesses.

-

Meanwhile, HUFLIT maintains a dense frequency of admissions-consulting livestreams from May to early August with the theme “Gen Z chọn ngành,” helping keep the discussion rhythm continuous throughout the peak season.

-

Dai Nam University also chooses an approach through career-orientation livestream sessions, emphasizing the role of long-term guidance for learners, thereby gradually nurturing quality discussions from the community.

Conversely, for most of the remaining private universities, CFQU and QU shares have not shown much movement. Discussions from quality users remain low, and content is mainly created from the schools’ official channels. This indicates these brands still rely heavily on their own voice, while community-based and naturally spreading discussions have not truly formed, creating a clear gap compared to the leading group.

On the other hand, most of the remaining private universities have not recorded clear changes in CFQU and QU share. Quality discussions remain limited, while content primarily comes from the schools’ official channels such as fanpages, websites, or admissions announcements.

Conversely, opinions, questions, and shares from learners, parents, or alumni—the actors who form the community voice—still appear quite rarely. When these exchanges have not been clearly formed, the depth of discussion and the ability to spread organically are therefore not yet high, creating a significant gap compared to the leading group.

2.2 Which schools lead in discussion scale, and which have an advantage in substantive interaction?

The Qualified Users (QU) chart shows that discussions about universities are clearly polarized between level of mentions and level of genuine interest. Two reference benchmarks for the full dataset are 5.59% QU share and 57.28% ROQU, helping identify which discussions stop at mere appearance and which can keep users engaged to explore more deeply.

See more: Private University Admissions Season 2025: Vibrant communication activities, diverse and engaging deployments to attract applicants

The group delivering standout effectiveness includes PHENIKAA, HUFLIT, and VHU—schools that both appear consistently in discussions and maintain high interaction. PHENIKAA accounts for nearly 10% of total QU with ROQU around 70%, showing that activities like the Colorstorm music event not only attract attention but also move users toward real interest in the learning environment.

HUFLIT, although its discussion scale is not too large, still exceeds the average ROQU thanks to the Confession platform and admissions livestreams, where users both share experiences and access needed information. VHU maintains ROQU around 60% through content directly tied to current students, making discussions more practically referential and easier to build trust.

Next are VLU, HUTECH, FPT HN, and Dai Nam, belonging to the group of schools with very high appearance frequency in discussions, but users’ depth of interest has not kept pace. VLU alone holds over 30% QU share—the highest in the TOP 14—yet ROQU is only 55%.

Content mainly revolves around trend-catching and student life, helping maintain steady reach but not creating a bridge to decision-driving information such as majors, scholarships, or career outcomes. Therefore, users may remember the school name, but they may not have enough basis to stay for deeper or more serious exchanges about study choices.

For schools UEF, HUBT, TLU, and NTTU, discussion scale is not large—only about 2–6% QU—but interest is quite clear as ROQU reaches 60–67%. The common point of this group is that content appears at the right time when users begin to consider seriously: stories about jobs before graduation, campus experience, or welcoming activities for new students. Although discussion volume is not high, each mention is associated with specific “evidence,” helping viewers visualize easily and become more willing to engage more deeply.

In the group HSU, HIU, and TDU, ROQU only reaches 50–53%, showing users have not found enough reasons to stay and learn more. The lack of persuasive and in-depth real-experience content such as student reviews, graduation stories, or standout training programs means initial trust is not yet formed. When specific value is not clearly shown, discussion struggles to expand in both volume and depth.

The data shows that media advantage does not come from creating many conversations, but from the ability to place discussions into the right learner needs. Schools with high effectiveness all do well in connecting community emotion with practical information, helping users move from “knowing about” to “wanting to learn more,” instead of stopping at merely “calling out” and knowing the school name.

3. Platforms & content that attract quality discussions around Private Universities?

3.1 Facebook is the dominant channel in nurturing a quality dialogue community about private universities

Platform data for discussions by quality users (QU) shows learners tend to join direct dialogue rather than only receiving one-way information. Discussions concentrate mainly on Facebook (63.7%) and TikTok (35.9%), while YouTube plays almost no meaningful role (0.4%).

Part of the reason is that schools’ communication activities today also mainly take place on platforms with large concentrations of pupils and students such as Facebook and TikTok, causing users to focus discussions in these familiar spaces. At the same time, these platforms enable fast responses, two-way exchange, and personal experience sharing—matching learners’ needs to research, compare, and verify information before making a decision.

Within the Facebook ecosystem, schools’ official fanpages are where most quality users concentrate, accounting for over 50% of total QU, far surpassing groups (Facebook Group at 7.1%) and personal accounts (Facebook User at 2.9%).

This distribution shows that content related to learning and choice decisions is mainly accessed through the schools’ official channels. This stems from communication activities being concentrated on fanpages and official channels mentioned above, making content directly published by schools occupy a high proportion. Thanks to that, deeper discussions often form around these information sources, where accuracy and updates are ensured.

Topics generating many discussions on Facebook also align closely with key milestones in users’ learning journeys.

Admissions and enrollment content clearly dominates during peak phases, from cut-off score announcements, enrollment guidance, to major and scholarship consultation.

These are “decision-making” information points, so users proactively ask questions, compare, and share personal experiences, making discussions organic and continuous. Alongside that:

Content about military semester or graduation ceremonies maintains stable interaction because it is tied to everyday experiences and students’ emotional attachment, contributing to extending the discussion lifecycle even after the official learning process ends.

On TikTok, quality discussions focus more on short, visual, and easily accessible content. Videos about major selection advice, cut-off scores, and the 2025 admissions season appear consistently across many schools, serving as a quick reference channel for users before they dig deeper.

Some content series like “Vũ Trụ Ngành Nghề” often reach 100–600 discussions per video, showing TikTok fits the need for quick comparison and initial perception shaping.

Experience- and emotion-driven content is also well received by TikTok users. Graduation imagery, student life, military semester, music events, or facilities attract attention thanks to being visual and relatable.

Posts about dormitories, diplomas, or everyday moments also generate a notable volume of mentions, reflecting the desire to “preview” the learning experience through an insider’s lens.

Overall, the data shows Facebook and TikTok are taking on two different but complementary roles. Facebook is where users seek clear information and engage in deeper discussion, while TikTok helps them quickly visualize the learning environment and student experience. Quality discussion therefore does not come from appearing across many platforms, but from choosing the right platform for each content type and the right timing for when learners need information.

See more: Analysis of social media feedback about private universities: What do users value?

3.2 Credibility from official channels leads discussions: Owned Media still holds a central role

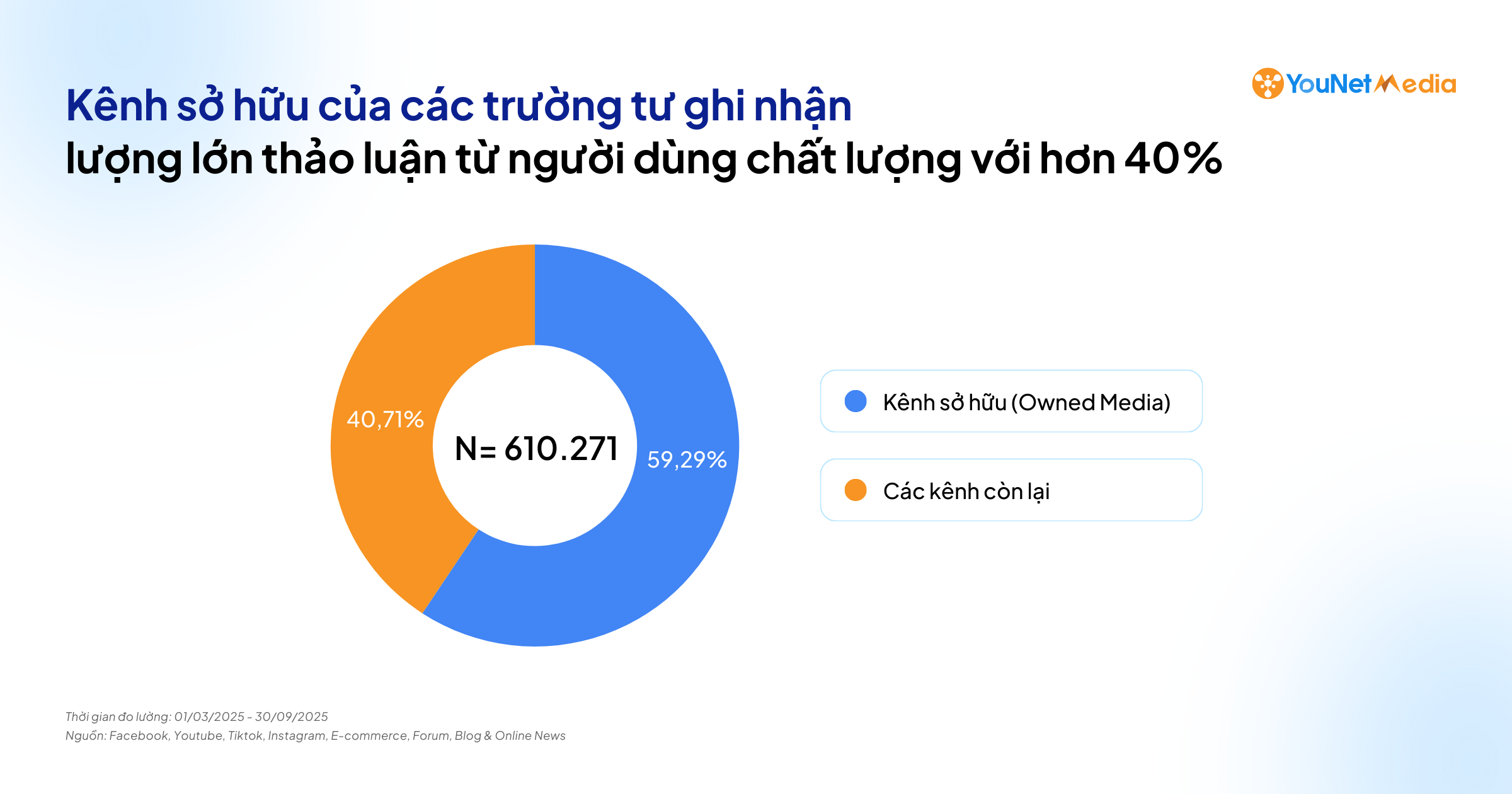

The picture of CFQU sources shows that quality discussions in admissions communications do not spread randomly, but concentrate around touchpoints capable of shaping and guiding information. Channels directly owned and managed by schools (Owned Media) account for 40.71% of discussions from quality users, showing this is still where users prioritize when they need trustworthy information to reference or make decisions.

Looking at the TOP 10 prominent sources attracting the highest volume of discussions from quality users, HUFLIT Confessions leads with over 25K discussions, followed by the Phenikaa University and Dai Nam University fanpages, showing that maintaining discussions is not only about scale, but also about how content aligns with real needs. Content tracks such as admissions, majors, scholarships, or career orientation appearing consistently encourage users to return repeatedly, creating a continuous discussion rhythm rather than short-term spikes.

Besides official channels, community spaces such as Confession pages, Youth Union – Student Association channels, or student competition pages play an important supporting role. These are places where daily-life experiences, emotions, and personal stories are shared naturally, making discussions more relatable and easier to spread.

The remaining CFQU distributed across many other sources shows discussions can still form outside official channels, but are often difficult to sustain long-term. When lacking a clear and trustworthy information source for users to return to and verify, exchanges tend to stop at sharing emotions or personal experiences rather than developing into serious interest. This makes discussions possible to appear scattered, but hard to build depth and practical reference value for users during their research and decision-making process.

Overall, the data indicates effectiveness does not come from choosing only one channel type, but from connecting official fanpages with community spaces. When accurate information and lived experience are interwoven appropriately, discussions become not only more numerous but also deeper, helping users move from fleeting interest to substantive research.

4. Conclusion

Data from the 2025 admissions season shows that the private university segment not only saw a strong increase in social media discussion volume, but also clearly revealed competitive pressure in attracting genuine interest from learners. Although discussions were lively, only 35.50% of content came from the quality-user group, reflecting the gap between level of appearance and serious consideration in a long-term decision such as choosing a university.

A notable point is that communication approaches differ clearly among schools. Some schools such as Van Lang, Phenikaa, or HUFLIT not only provide official information but also proactively create spaces for learners and students to exchange, ask questions, and share experiences, thereby forming deeper discussions.

Conversely, many other schools mainly focus on maintaining presence on official channels, so community exchange remains limited and has not created a clear voice from learners. From this, it can be seen that both expanding reach during admissions season and nurturing real-world shares aligned with learners’ interests will be key factors helping private universities build sustainable advantages in an increasingly competitive environment.

YouNet Media, supported by YouNet Group, is proud to be the first unit in Vietnam to develop and apply the Content From Qualified Users (CFQU) metric into monitoring and measurement systems. CFQU enables accurate identification of what is real content, effectively removing advertising-like posts, repetitive posts, or content not coming from real users, providing the most truthful picture of communication effectiveness.

Thanks to that, every number and every analysis accurately reflects the voice and true reach from organic users, supporting businesses in strategy planning and decision-making based on “clean,” reliable data.